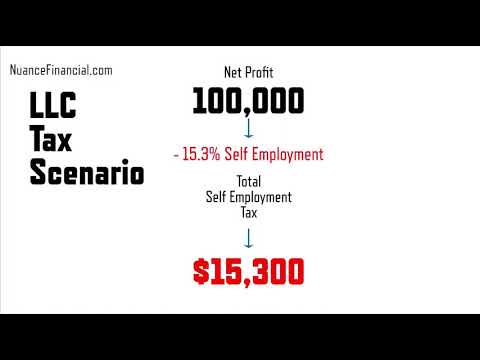

So, what is the difference between an LLC and an S Corp? First off, we are a financial firm based out of Minnesota, about 20 minutes south of Minneapolis. We specialize in accounting, bookkeeping, tax, and payroll services for small businesses, nonprofits, and individuals who earned 1099 income. We are also endorsed by Dave Ramsey as local providers in the southern half of Minnesota. Please note that all the scenarios we are about to present are for illustration purposes only and should not be considered as tax advice. It is important to consult with a professional to get advice tailored to your specific situation. Now, let's discuss the difference between an S Corp and an LLC. Both of them are technically LLCs, but when we refer to an LLC here, we are talking about an LLC taxed as a sole proprietor. On the other hand, when we mention an S Corp, we are actually referring to an LLC taxed as an S Corporation. Both LLCs and S Corps provide business owners with legal protection, creating a corporate veil between the company's assets and personal assets. They also offer operational advantages, such as partnerships and the ability to collaborate with others. Furthermore, they serve as pass-through entities for taxes, meaning that the profits and losses flow through to the business owner. Let's dig deeper into the specific tax considerations for both an LLC and an S Corp. In both cases, you will be calculating your tax based on your net profits. Net profit is what remains after deducting all your business's expenses from the gross income. In an LLC, your entire net profit is subject to self-employment tax. This tax is similar to the FICA or Medicare deductions you had when you were an employee at another company. As a self-employed individual, you are responsible...

Award-winning PDF software

1120-W Form: What You Should Know

Worksheet used to calculate the required amount of each quarterly payment for a corporation. Tax worksheets are used for estimated taxes to be paid in future quarters. For your corporation to pay a quarterly estimated tax payment, you must use Form 1120-W to figure the amount of your corporation's quarterly estimated tax payments. If your company uses Form 1040X for payroll deductions, you don't need to use the Form 1120-W, because you just report your income and expenses on your 1040X. With Form 1095, you pay estimated tax quarterly, at the beginning of each quarter, and you use the Form 1120-W to calculate your quarterly estimated tax payments. If the quarter ends and the corporation doesn't pay its quarterly estimated tax, you will be allowed to issue refunds. If the corporation doesn't pay its quarterly estimated tax, you will be required to issue a Form 1099-G. If your company uses Form 1120-W, you must file a report of estimated tax payments on your company tax return, as soon as the quarterly tax payments are due. This report is in Box 1 of your Form 1120-W. (The Report of Estimated Tax, or MEET, must be completed by employees and owners of a partnership.) The first part of Form 1120-W is a worksheet that calculates your quarterly estimated tax payments. To calculate these payments, you will need your corporation's information about income, expenses, and other business-related items, and the amount your corporation should pay. For information about the amount your corporation should pay, see the instructions on Form 1120-W. The second section of Form 1120-W is a spreadsheet that you print out or print. On the Worksheet, you use this line of code 0xA8 to make your corporation's Form 1120-W report the number of the worksheet. The worksheet that will be used to calculate your quarterly estimated tax is described with the code 0×00 in Box 9. The third part of Form 1120-W is an Excel spreadsheet that you will use to calculate the amounts each corporation should pay. For information about the amounts your corporation should pay, see the instructions on Form 1120-W. Enter the amounts each corporation will pay. To do this, first print out the Worksheet and follow the instructions for the Worksheet. Next, use the worksheet to calculate the amount each corporation should pay.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1120-W, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1120-W online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1120-W by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1120-W from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1120-W