Award-winning PDF software

1120 W large corporation Form: What You Should Know

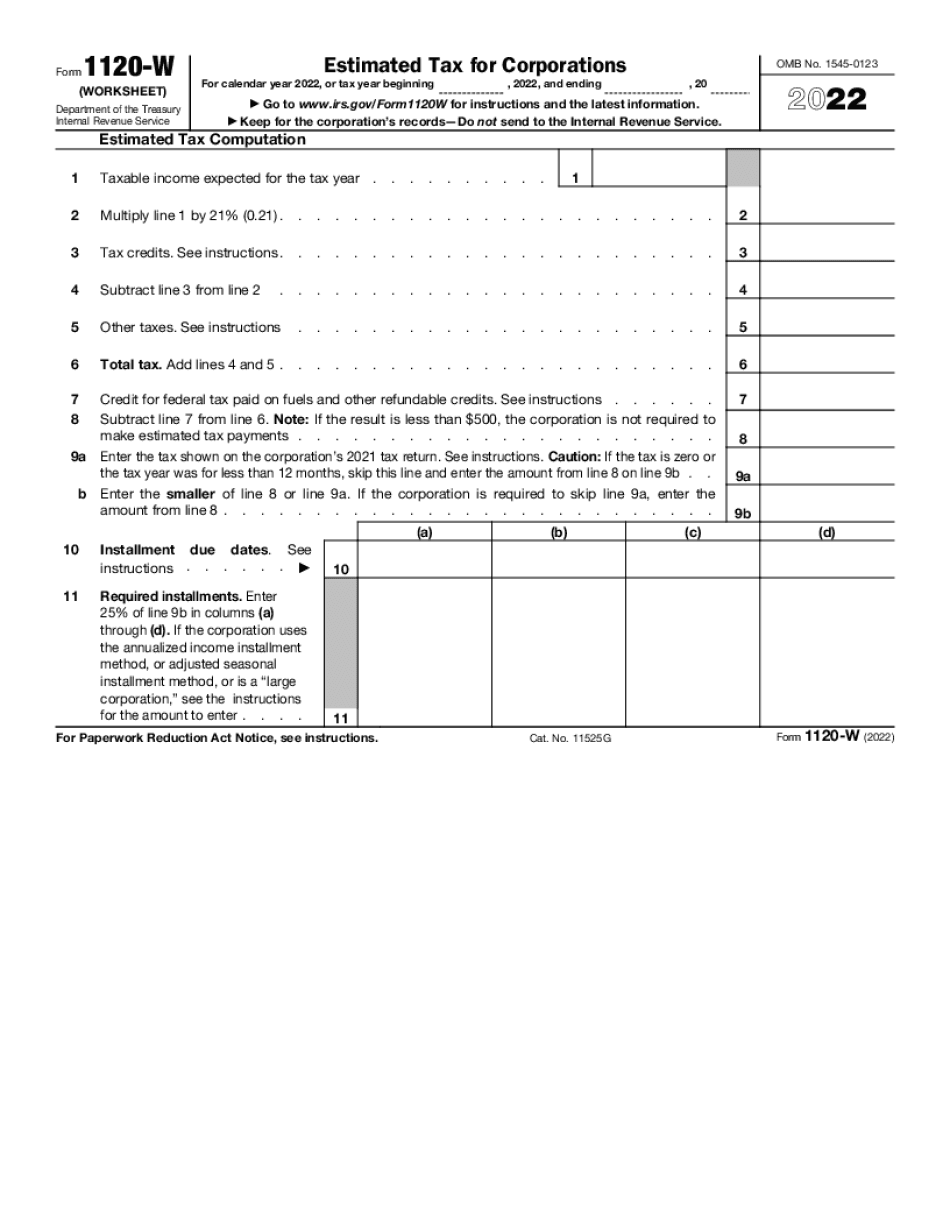

For some tax years, the amount of estimated tax is the statutory amount of estimated tax. The statutory amount of estimated tax is either 100% or an amount that is the sum of any taxes the corporation would normally pay on the corporate net income for the period of the estimated tax calculation. The amount of actual taxable income of the corporation for the period of the calculation is not included in the actual estimated tax. This means that the actual estimated tax amount is the amount of tax that would actually be paid (after any state, local or other taxes are applied) by the corporation for the taxable year. If there are any tax breaks or any credits allowed by statute, they will also be included in the corporation's actual estimated tax amount. If a taxpayer receives a refund of tax on an overpayment of tax and there are no tax breaks or credits allowed by statute then the actual tax amount is the tax paid on the overpayment of tax. Estimated tax calculations may become inaccurate and have a negative effect on a corporation's operating results due to a number of factors. For example, a company could overestimate its losses, which it could then deduct against taxable income during the tax year, instead of paying them when they are incurred. However, a company will always pay estimated tax regardless of whether its losses are greater than its estimated taxes due. Estimated tax is an important part of any corporation's income tax obligations. Estimating your estimated tax is an important part of preparing your taxes and reducing the amount of tax you pay in the future. This article will go over the various methods of establishing a corporation's estimated tax liability. Estimated tax calculations can be a pain for taxpayers. You have to do it by hand and get a lot of flak for mistakes. Fortunately, there are an estimated tax worksheet to help avoid the headache of estimating your taxes. Estimating your estimated tax is the only way for you and your accountant to determine the correct amount of taxable income for the taxable year. The worksheet has been prepared by the IRS, and it contains the estimated tax for tax years 2007, 2008, 2009, 2010, and 2011. The estimated tax can give you a good idea about what you need to pay tax on and also provides you with the information you need to complete Form 1120-W, Estimated Tax for Corporations.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1120-W, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1120-W online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1120-W by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1120-W from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.