Award-winning PDF software

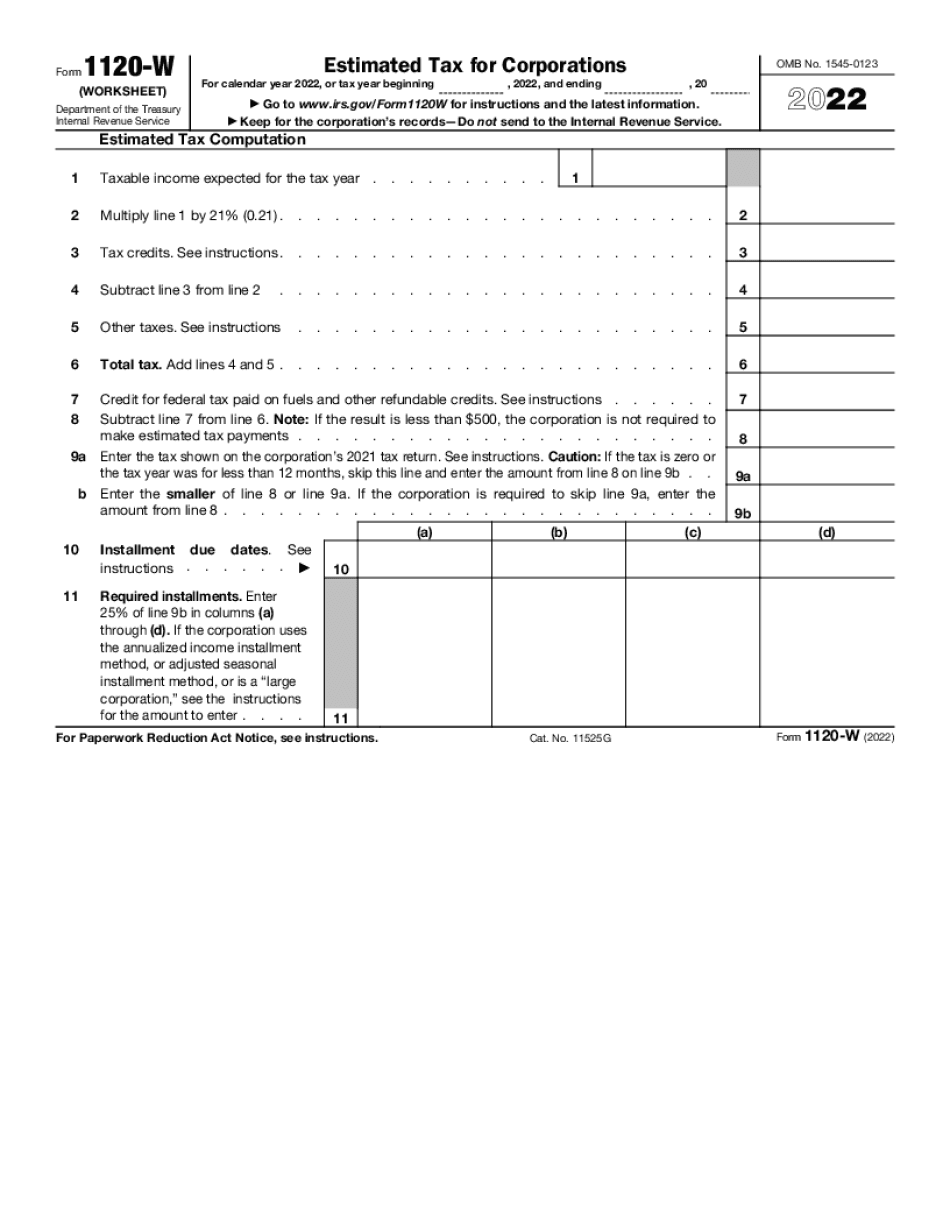

1120w instructions Form: What You Should Know

Form 1256 for final corporate payments. An S corporation receives an allowance of up to 50 that is used to offset corporation corporate income tax on certain payments and is used in making corporate payments to an affiliate. Corporate Tax Process — Overview The Corporation tax is imposed equally on individuals, corporations, and other partnerships and limited liability companies. There is no tax liability for dividends received from a business or other source (except interest) unless the dividends are paid to a controlled foreign corporation. For some investors, a limited liability company is their primary or only investment vehicle. For more information regarding limited liability companies, see Limited liability companies. When calculating the amount of corporate tax attributable to S corporations, one of three approaches is used. This report looks at how each approach works, what's important when choosing among them, and how these approaches would effectively apply if an individual were determining the corporation's corporate tax liability. These are the three approaches. 1. Application as a Qualified Refund This approach applies the standard corporate tax treatment that results in 1 of corporation tax being excluded from the gross income of the individual for each 1,000 of corporate income. Example. An individual files Form 1120-W with his or her income tax return for the tax year 2017. The individual has gross, taxable income of 100,000. The individual's taxable income for tax year 2025 is 150,000. Under this assessment, 25,000 of net taxable income is excluded from 100,000 to 150,000 of taxable income (10%) but the 25,000 of gross income from a trade or business is not excluded. Qualified Refund If qualified refund applies, the individual pays 1,000 of corporation tax (10%) to a limited business entity. Example. This is the taxpayer's choice. If this is not the taxpayer's choice, then the taxpayer would have gross income of 100,000 and 25,000 to 99,999 of non-taxable income (20%) is excluded from gross income. Exclusion from taxable income Exclusion from taxable income is not used. All the 25,000 of non-taxable income (20%) is applied to corporation income tax liability. The 100,000 taxable income is taxed at 10%.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1120-W, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1120-W online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1120-W by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1120-W from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.