I'm about to make a lot of people angry. Other CPAs may hate me for this, but I'm about to give away our IRS trade secrets. Every day, taxpayers paid thousands of dollars to CPAs, attorneys, and enrolled agents to help them with IRS tax problems. More often than not, with a basic understanding of how the IRS handles the filing and paying of taxes, people can solve their own IRS problems. So, click the link below and download my free ebook with exact instructions that you'll never find elsewhere, no matter how much money you pay for professional representation. This ebook is filled with techniques from my many years of experience, showing you a road map to get you through the system. Click on it now or you can listen to more of what I have to say. I'm Joe Mass Triano, CPA, and after 30 years and thousands of tax cases, I know the IRS business like the back of my hand. I'm so angry that things have gotten so bad in this country that the IRS has beefed up audits and collections. People are outraged by the additional taxes they're being charged with and the aggressive actions taken by the IRS to collect them. They feel forced to seek professional representation to protect them against our own government. Knowing this, every CPA, attorney, and enrolled agent has now come out of the woodwork, claiming that they are experts in representing taxpayers before the IRS. They put up cookie-cutter sites, all making the same claims of how effective they are. "We get your levy released in the shortest time, we lower your taxes the most, we have the most offices, we have the most clients, we have the best Better Business Bureau rating, you'll get off at flat...

Award-winning PDF software

Irs 1120w instructions Form: What You Should Know

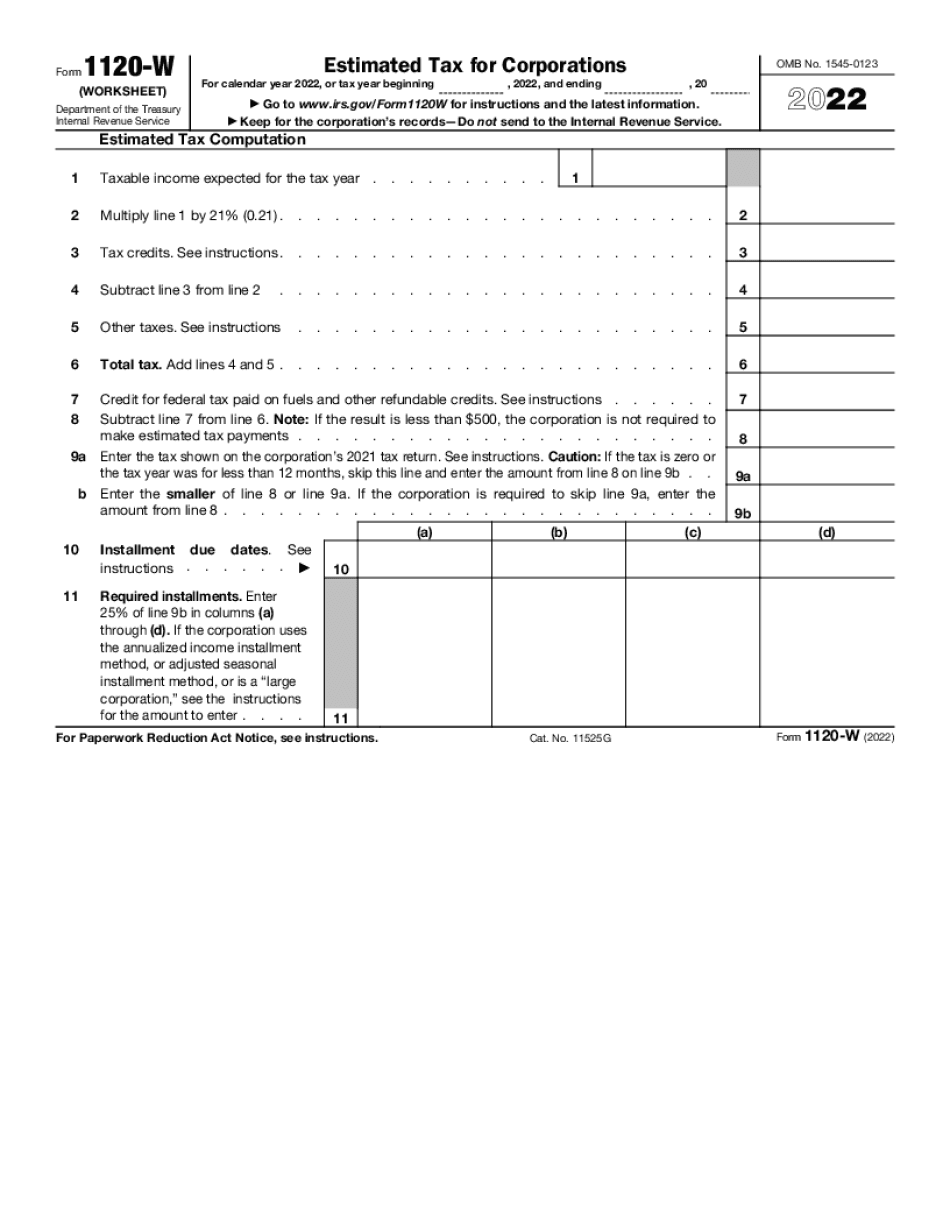

Use Form 1120-W (Worksheet) to estimate the tax due on the income of a U.S. corporation for the tax year for which the return is filed. A U.S. corporation generally reports income for tax purposes on Form 1120. If you are an individual, report on a separate line of Form 1040, line 20, and the total of Forms 1040P and 1040EZ for the calendar year. A corporation generally reports its income for tax purposes on Form 1120, line 27. The amount shown on Form 1120-W may be different from the amount shown on the individual's income tax return for the year.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1120-W, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1120-W online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1120-W by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1120-W from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs 1120w instructions