Music, applause, music. Howdy, this is David Grocer, the Texas tax and law man. Let's talk about estimated tax payments. - Nobody loves paying taxes. Scratch that, I don't know anyone who even likes paying taxes. However, most Americans have their taxes taken out of their checks before they receive it. The IRS calls that withholding, and the IRS loves withholding because with every paycheck you receive, Uncle Sam gets paid. To put it differently, Uncle Sam is looking forward to your paycheck as much as you are. - In my mind, I think of Uncle Sam like the eccentric uncle who sleeps on our couch down in the basement and can't wait to blow every dollar you bring home. But worse than that, he runs up our credit card to fund his pet projects, like giving Swedish massages to rabbits or teaching mountain lions to ride treadmills. - If you think I made those things up, check out this article from CNS news.com that cited the study of US Senator Tom Coburn. I hope this mental picture sticks with you because I personally believe that you know better how to spend and save the money you earn than does the government bureaucracy. - Yes, I know government provides for the common defense, builds highways, and funds schools, but local control by people we personally see, know, vote for, and who answer to us directly is closer to the ideals of our founding fathers than the Leviathan of government we have today. - So back to estimated taxes. There is no law that says thou shalt make estimated tax payments. However, Internal Revenue Code section 66 54 says that if you do not make estimated tax payments, then the IRS will impose two charges on you: late payment interest and late...

Award-winning PDF software

Corporate Estimated Tax Payments Safe Harbor 2025 Form: What You Should Know

Pay either corporate or pass-through income tax are subject to the rules and regulations established by the Federal.

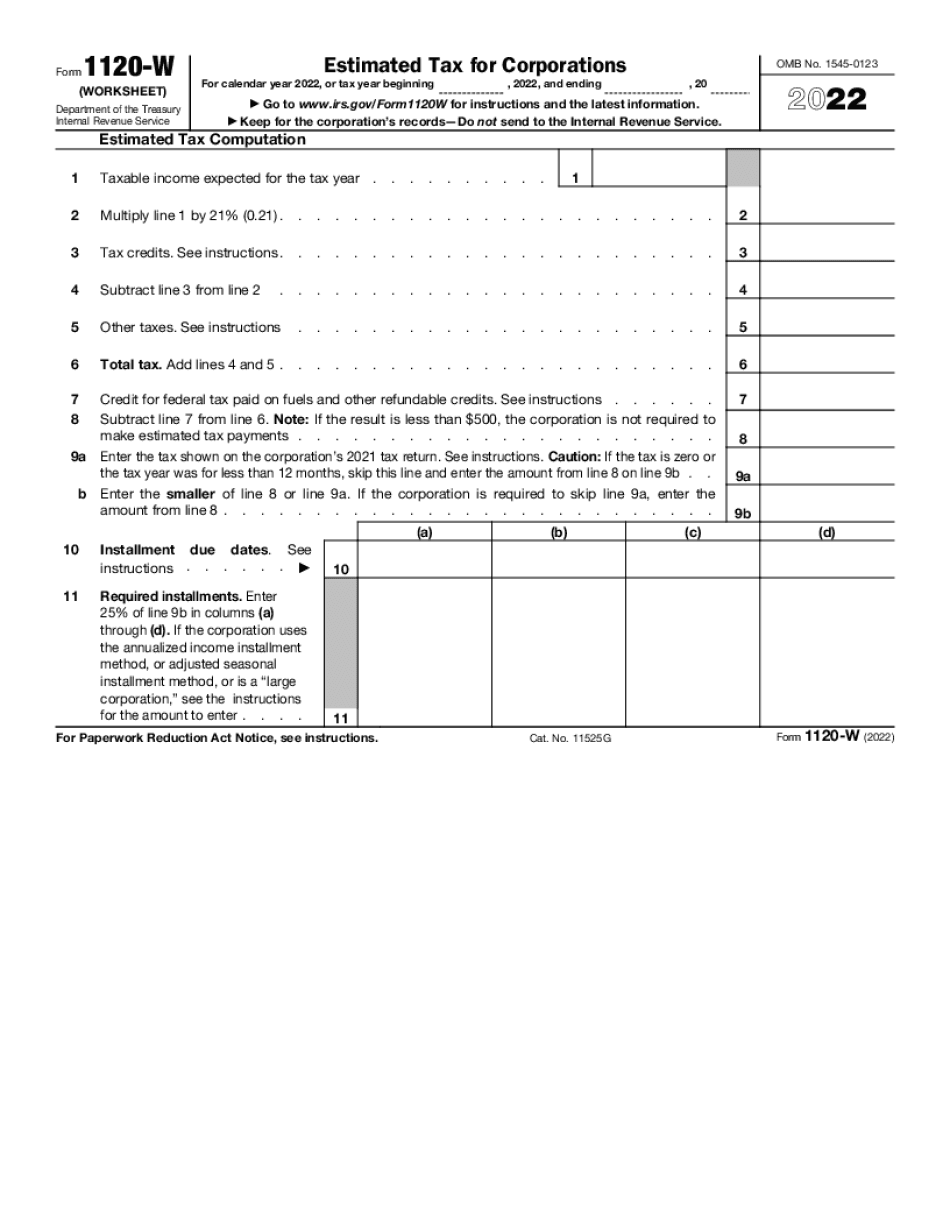

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1120-W, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1120-W online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1120-W by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1120-W from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Corporate Estimated Tax Payments Safe Harbor 2025