Hey guys, it's Anthony Fontana here. I'm an IRS enrolled agent with EI Tax Resolutions, and today I'm answering my clients' favorite question: How do I pay the IRS? Okay, so how do we pay the IRS? It's a great question. We've got five ways that we can pay the IRS. You can pay when you file online, by phone, by mail, or through, believe it or not, the IRS has a smartphone app that you can use to pay the IRS. Okay, let's start with the easiest way to pay the IRS. It's when you file. So if you e-file, which most people do, beware: most e-file software providers do not offer the credit or debit card option to pay the IRS. Some do, so you'll want to check with the e-file software provider before starting to prepare your return if that's what you're thinking of how to pay for your taxes. Just be aware, if you do use the card, they will charge a processing fee for your transaction. Now, if you're going to use your checking or savings account, all you'll need is the account number, the routing number, and a date you want the funds to be withdrawn from your bank account. Be sure the date is before your due date, and once you click "file," the IRS will then take the funds out of your bank account on the chosen date. Now, on the flip side, if you pay per file, which some people still do, all you have to do is include a check or money order in the envelope that you include your tax return in. Be sure to make the check or money order payable to the Department of the Treasury, and include your social security number, the tax year, and the tax form that...

Award-winning PDF software

Where do i mail my federal estimated tax payment Form: What You Should Know

Mailing Addresses for Estimation Tax Payments If You Live In: The New York State Department of Taxation and Finance provides instructions on how to submit Form 1040-ES estimated tax payments. 2028 Federal Quarterly Estimated Tax Payments You may credit an overpayment on your 2025 tax return to your 2025 estimated tax;; You should mail your payment with payment voucher, Form 1040-ES 2022 Federal Quarterly Estimated Tax Payments You may credit an overpayment on your 2025 tax return to your 2025 estimated tax;; You can mail your payment with payment voucher, Form 1040-ES; 3 days ago — Note: The first line of the address should be 1040. Mailing Addresses for Payment of Estimated Taxes If You Live In: 2022 Federal Quarterly Estimated Tax Payment 2022 Federal Quarterly Estimated Tax Payment | It's Your Yale You can also submit estimated payments using Form PV. the Comptroller s Office has discontinued the mailing of the Estimated Personal Income Tax Packet. 4082 Federal Quarterly Estimated Tax Payment If you reside in Alabama, you may credit an overpayment on your 4082 tax return to your 4081 estimated tax; and you may mail your payment with payment voucher, Form 1040-ES 3027 Federal Quarterly Estimated Tax Payment Schedule 2022 Federal Quarterly Estimated Tax Payment Schedule | It's Your Yale 4 days ago — Note: The first line of the address should be 1040. Mailing Address for Payment of Estimated Taxes If You Live In: Payments can be made by credit card, check, or money order to: The New York State Department of Taxation and Finance provides instructions on how to submit Form 1040-ES estimated payments. 4081 Federal Quarterly Estimated Tax Payment Schedule Payments can be paid by credit card, check, or money order to: Payments can be made on behalf of an estate to the Federal Trustee. The instructions are available in the following publications: You can request an original Form 1040-ES from the New York State Department of Taxation and Finance; you may want to see: If you choose to go this route, you must know how to pay electronically. Please follow these steps: Pay With a Credit Card Sign up for an account at Bank of America or Discover Bank and get online payment instructions.

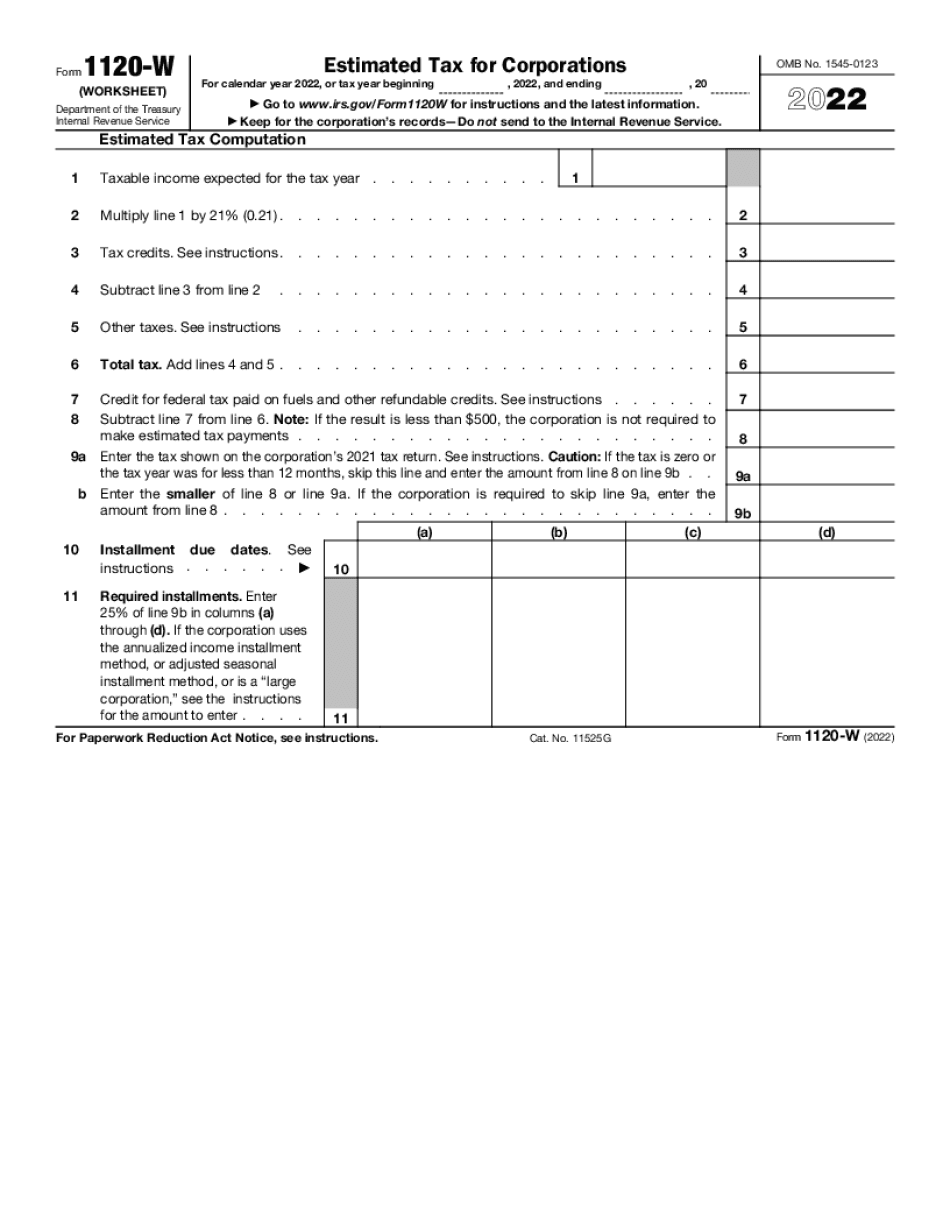

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1120-W, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1120-W online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1120-W by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1120-W from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Where do i mail my federal estimated tax payment