Award-winning PDF software

Form 1120-W Escondido California: What You Should Know

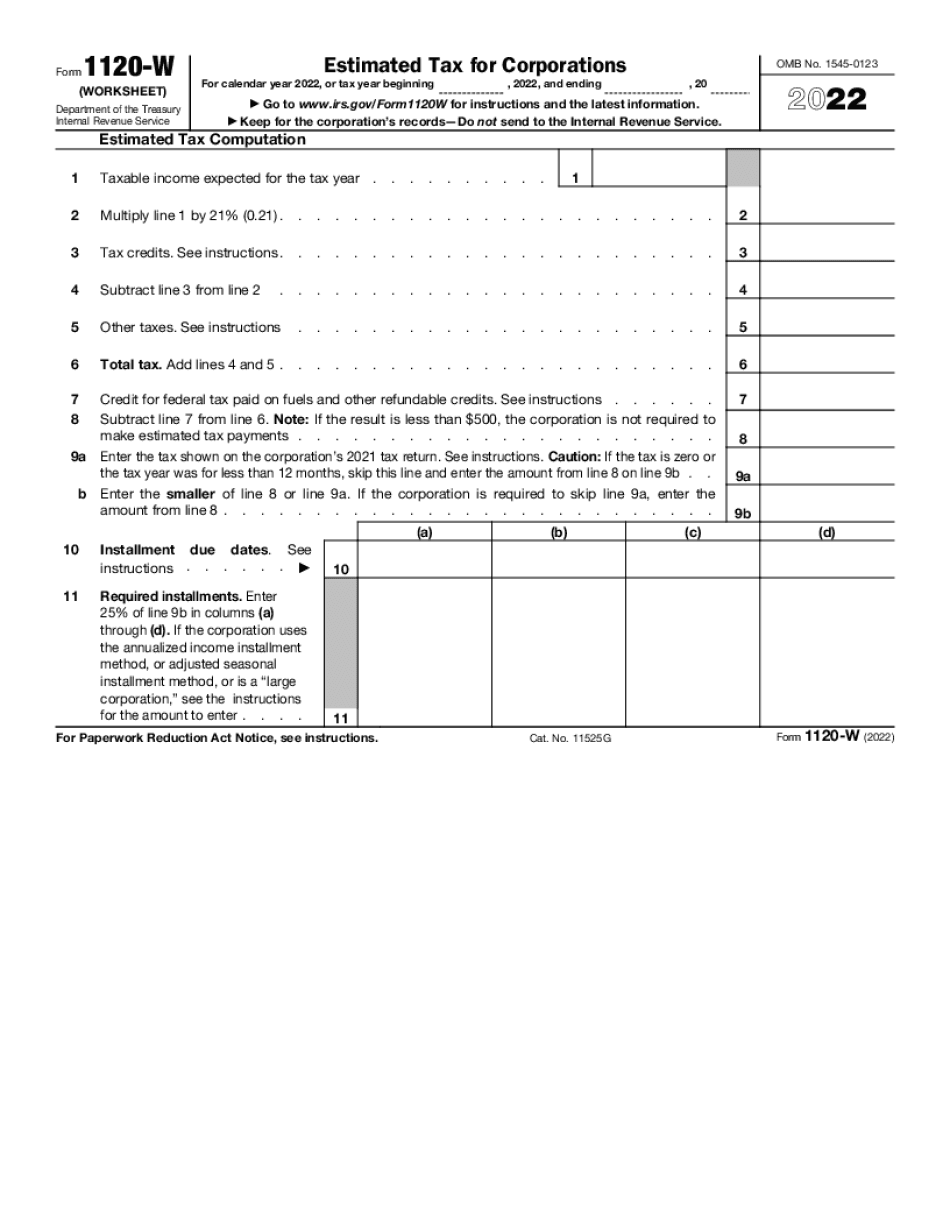

What can the 1120-W form do for me? 1. Estimate the tax due Income tax is calculated as follows: The net income from all sources is reduced by the deductions and special payments in excess of the applicable income tax. These include: Businesses paid more than the normal income tax rate, Special deductions paid or not allowed, A credit for the tax paid on property not previously taxed to the corporation. Special payments are treated as tax deductions, i.e., the corporation can treat these as regular deductions. These include: Interest, dividends, or capital gains on shares of stock capital (involving property received as a commodity), Investments, and Payments of employee wages and allowances. In addition, any non-business items taxed on corporation income would also reduce income. Examples include: Capital cost allowance. The tax paid on corporate interest. The amount of personal expenses for use of a personal residence. Capital investments in small businesses (for example, equipment for start-ups or small retail stores). Capital expenditures, including improvements for business establishments Payments due on tax-exempt bonds and other special interests. The total estimated tax due will depend on the number of units of property, business activities, and the tax rate. 2. Calculate your income tax in the following way: For 2017, the IRS estimates the following amounts for you based on the years of the business: Estimated tax on corporate income as it is reported on Form 1120-W. This number will be reduced by: Special payments to a small business (including an interest deduction). Special payments to a charity or foundation, Special payments to individuals, Unpaid taxes due on dividends, interest, capital gains, and other amounts. For 2018, the IRS estimates similar amounts for you based on the years of the business: Estimated tax on corporate income as it is reported on Form 1120-W. This number will be reduced by: Special payments to a small business (including an interest deduction). Special payments to a charity or foundation, Special payments to individuals, Unpaid taxes due on dividends, interest, capital gains, and other amounts. The amount of income you earned in a year from any of the following types of businesses does not automatically add back to tax: Sales on a personal residence.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1120-W Escondido California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1120-W Escondido California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1120-W Escondido California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1120-W Escondido California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.