Award-winning PDF software

Form 1120-W online Nashville Tennessee: What You Should Know

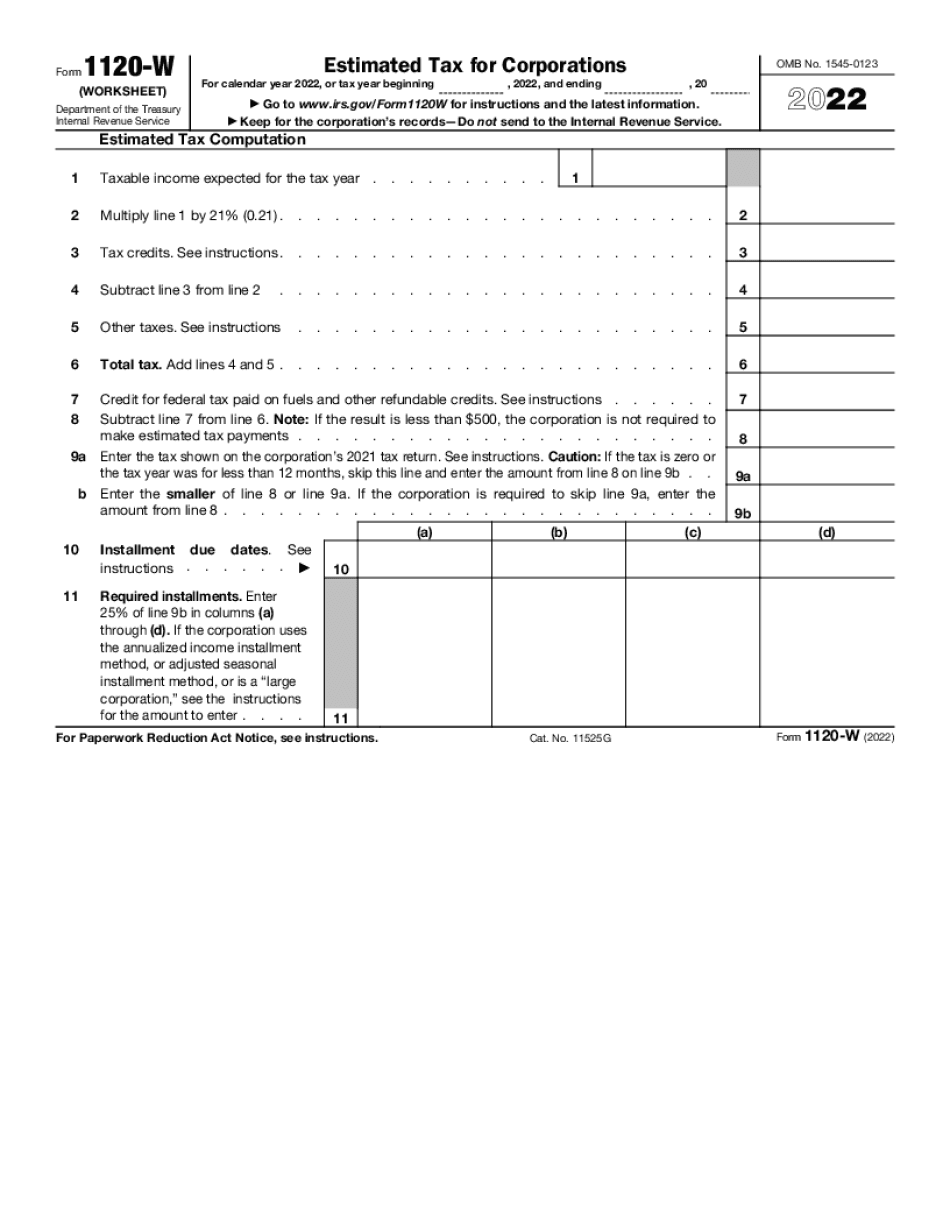

The first part of the worksheet explains how many installments the corporation is required to make and the types of installments that must be paid, as well as the expected tax rate. The form also describes a method to determine the amount of tax the corporation or each shareholder actually owes. The first part of the worksheet is for the shareholder; the second part is for each other taxpayer. It requires the taxpayer to identify the corporation's name and address. If you use either the parent corporation or a subsidiary corporation, the Form 8283, “Business Profit or Loss, Net of Items” should be filled out as described on page 4 of the Form 8283. In the first part of the worksheet, the taxpayer must enter the name of the corporation. The IRS also asks to know what type of business the corporation is operating. It might show the corporation's business or financial results for one or more prior taxation years and ask to know how these have impacted the corporation's taxes. To find out how many installments must be paid each year, the second part of the worksheet asks the taxpayer about the amount of dividends and interest it is paying that year. The fourth column of the worksheet is filled with the information shown on page 9 of the Form 1040 instructions, including the amount of each type of dividend and interest paid to the corporation. This column is also filled out by the shareholder, but it indicates the taxpayer's name and number. The fifth column is filled with the amount of corporate shares owned by each shareholder. To calculate the amount of installment the corporation owes to the shareholder, the sixth column shows where the installments must be paid from, and the seventh column shows what each installment is to be paid for, and in which month. The seventh column is also filled out by the shareholder, but it indicates the taxpayer's name and number. The eighth column, the amount at the top of the worksheet, shows the amount that the shareholder is required to pay in each month. The fifth, sixth and seventh columns show what each installment is for. This column might be labeled “Dividend Payments” or, if it is the first installment for any type of interest payment, “Interest Payments” or “Interest Payments.” The eighth column indicates that each month each installment is due. Form 1120-W is completed and checked by the shareholder, not the corporation, on the first day of the next taxable year.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1120-W online Nashville Tennessee, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1120-W online Nashville Tennessee?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1120-W online Nashville Tennessee aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1120-W online Nashville Tennessee from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.