Award-winning PDF software

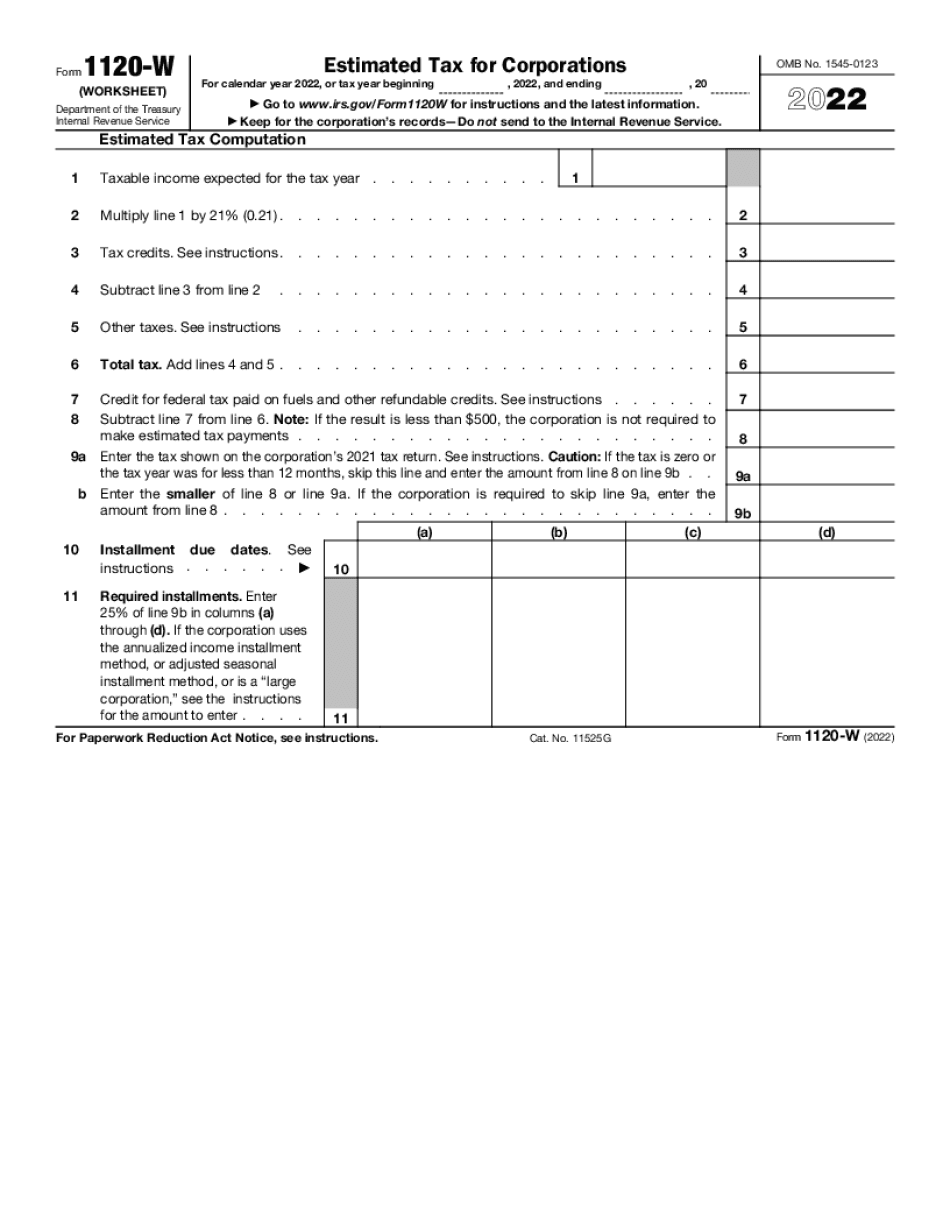

Printable Form 1120-W Omaha Nebraska: What You Should Know

Do not report on a Schedule D. For information about Form 1120-W and other 2025 changes, visit the website of the U.S. Department of Treasury. Employment income. Tax credit for qualified hiring bonuses. Earned income credit. Health coverage tax credit. Additional tax credits for high-income taxpayers. Tax rates. The Tax Cuts and Jobs Act, enacted on Oct. 1, 2018, lowers the rates for individuals, heads of households, and married filing jointly. The Act also permanently repeals tax preferences for oil and gas producers. Individual and sole proprietor taxpayers. The new standard deduction and personal exemptions are increased. These changes will reduce the number of eligible taxpayers and increase the number of tax returns that are assessed the new 7 tax rate bracket rate structure. Married taxpayers. The Act repeals the marriage penalty. Under current law, the Tax Cuts and Jobs Act reduces taxable income of people married to one another by reducing the number of tax years that each taxpayer will have to pay additional tax on income earned (e.g. the number of tax years each spouse has to delay income that will be taxed at the higher rate). Now each married tax taxpayer can choose whether to take this penalty or not. If they do not take the penalty, then they will not have to reduce their own income by an additional 1 tax year, because the amount of income earned each income year will not change. The new rules will reduce the tax liability of married taxpayers by an average of 12% of the adjusted gross income (AGI). The new rules also increase the number of married taxpayers that are eligible for the standard deduction. The tax changes in the Tax Cuts and Jobs Act make many personal tax changes, some more significant than others. These changes include: Reduced filing requirements for individuals. The filing requirements to claim the new itemized deduction or personal exemption have been greatly simplified, simplifying the process. The filing requirements to claim the new deduction for qualified business income under section 199 of the Revenue Act of 1978 are substantially simplified with the elimination of the personal exemption. The filing requirements to claim the new deduction for contributions to the Educational Savings Accounts have been substantially simplified.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1120-W Omaha Nebraska, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1120-W Omaha Nebraska?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1120-W Omaha Nebraska aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1120-W Omaha Nebraska from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.