Award-winning PDF software

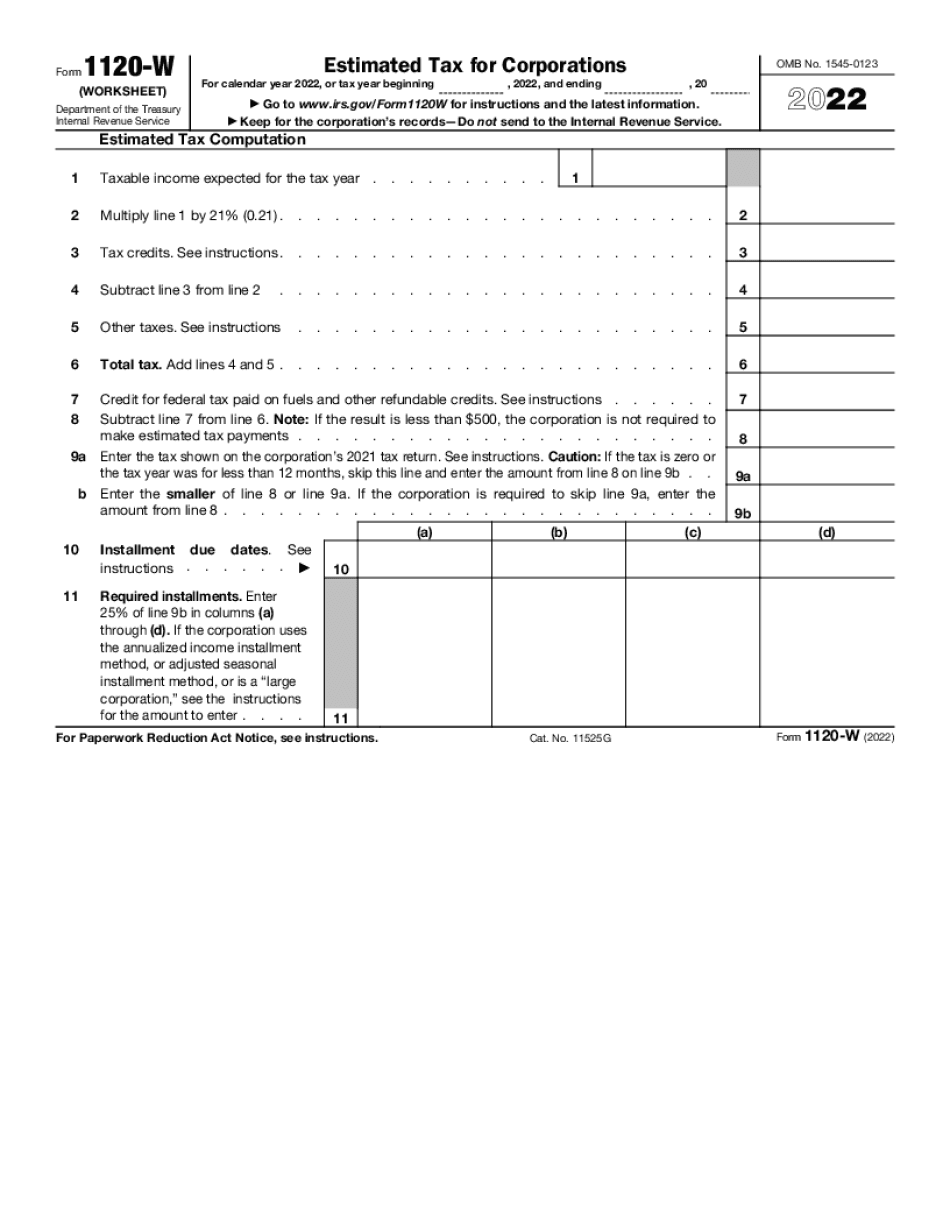

Los Angeles California Form 1120-W: What You Should Know

Disclaimer. This form is for general information only. This form does not give, or guarantee, a legal or financial advisor's opinion or recommendation to an individual. It is, as such, intended as the only source of information on any specific issue. No tax advice should be sought after reading the information on this article. The information presented in this guide is subject to change without notice, and the author will not be liable for any direct or indirect, special, incidental, or consequential damages arising out of its use. This form does not constitute tax advice or counsel. The legal counsel to the reader should therefore refer to their tax professional for advice. The opinions expressed here are those of the author and may be affected by other legal and financial circumstances. The opinions expressed here are those of the author and may be affected by other legal and financial circumstances. The author does not provide, nor is the author likely to take any action of any kind on your behalf. The views set forth here, though expressed, are solely those of the author. For those unfamiliar with the calendar years, that is when each year begins and ends with a new year; therefore, you have two years to file; the tax year is the regular tax calendar year. It is the tax year that starts and ends with the new year. The calendar year ends with the end of the financial year, or the end of the financial year before the beginning of the next calendar year. To calculate your taxes, you determine all income of interest and dividend pay from the prior year, subtract this from the amount you had to report in the current year to get the return owed. There are a few other deductions the form allows that are unique to the tax year, such as a state or federal tax credit, the interest paid on tax bonds, and the interest paid on the mortgage on the home. There are two ways to calculate gross income for California income taxes and this form is the way to report gross income for those who are paying other states income taxes. How to calculate income tax A. Calculator Enter your 2025 taxable income. Enter a net worth from the prior year. Enter the interest paid on debt that you financed.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Los Angeles California Form 1120-W, keep away from glitches and furnish it inside a timely method:

How to complete a Los Angeles California Form 1120-W?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Los Angeles California Form 1120-W aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Los Angeles California Form 1120-W from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.